After 5 months of solid gains, are markets ready for a pause? Bullish Presidential Cycle Sitting President Pattern flattens out the mid-February to late-March seasonal retreat considerably without 2020 in the average.

April is the final month of the “Best Six Months” for DJIA and the S&P 500. From our Seasonal MACD Buy Signal on October 9, 2023, through (March 21, 2024), DJIA is up 18.4% and S&P 500 is up 20.9%. Fueled by interest rate cut expectations and AI speculation, these gains are approximately double the historical average already and could continue to increase before the “Best Months” come to an end.

'Best Six Months' ends in April.

April is the final month of the “Best Six Months” for DJIA and the S&P 500. From our Seasonal MACD Buy Signal on October 9, 2023, through (March 21, 2024), DJIA is up 18.4% and S&P 500 is up 20.9%. Fueled by interest rate cut expectations and AI speculation, these gains are approximately double the historical average already and could continue to increase before the “Best Months” come to an end.

This AI-fueled bull market has enjoyed solid gains since last October and will likely continue to push higher in the near-term, but momentum does appear to be waning with the pace of gains slowing. With April and the end of DJIA’s and S&P 500’s “Best Six Months” quickly approaching we are going to begin shifting to a more cautious stance. We maintain our bullish stance for 2024, but that does not preclude the possibility of some weakness during spring and summer.

THE CORRELATION MODEL SEES A NEGATIVE LAST WEEK OF MARCH FOR THE S&P. Provided a time frame of interest, my correlation model calculates the Correlation Coefficients (-1 to +1) for the past performance of 4165 different time frames over the prior 3 months vs the performance for the time frame of interest in search of the period which has demonstrated the most barometric acumen in predicting the performance of the upcoming time frame of interest.

This week I ask the model for it’s prognosis for the S&P in the last week of March. It responded that the prior ten calendar days (Mar10-24) had a very uncanny track record of forecasting the last week of March with those 2 time frames having a very strong NEGATIVE correlation which doesn’t bode well for next week given that March 10-24 was up 1.63% this year.

Note the 3-10, March 24-31 performance in the far right category below in those 13 prior years where March 10-24 was greater than 1.2% for an avg wkly loss of 0.74% with 1% moves 1-7 to the downside. This contrasts dramatically to the 11-2 performance when March 10-24 was less than -0.5%. Fingers crossed that it is wrong this year.

The outlook for April is much brighter.

Reference:

[ oftentimes true: ]

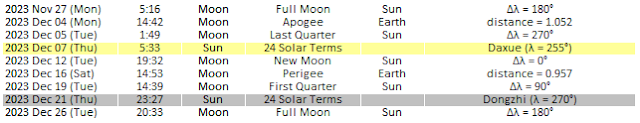

In Bull Markets, New Moons are Bottoms, and Full Moons are Tops.

In Bear Markets, New Moons are Tops, and Full Moons are Bottoms.

The SoLunar Rhythm in March 2024.

.png)